Best Loan App in India – चुटकियों में लोन बैंक खाते में कहीं भी

Dear friends if you wants personal loan and without income proof 3 are the best loan app in India that can provide the loan Between 5000 to 1 lakh.

100 Loan Apps with Proof:- Click

Kissht Credit Line?

Credit Line is a one-way Amount that is booked in your account for 2 years and it works like Credit Line as Credit Card but it doesn’t give you as much time as credit card. Here you can also transfer this Kissht Credit Line to your bank account for which you have to pay the prescribed interest.

| 1. | App Name | SmartCoin – Personal Loan App |

| 2. | Downloads | 5M+ |

| 3. | Ratings | 4.4*/5 |

| 4. | Reviews | 158K+ |

| 5. | Loan Amount | Rs. 1000 – 1,00,000 |

| 6. | Tenure | 2 Months – 12 months |

| 7. | Interest Rate | 0% – 30% Yearly |

How much Loan can I get from Kissht Credit Line?

Borrower’s profile based on more than Rs. Credit Line Limit of 30,000 and Rs.1,00,000 can get loan amount.

What are the documents required for Kissht Credit Line?

You only get the loan limit on the base card and the PAN card but your CIBIL score is also checked. If you have a 700+ CIBIL score, you get a credit line account easily.

How to Apply for Credit Line in Kissht App?

- 1.First you have to download Kissht App.

- 2.After that you have to login with the mobile number.

- 3.After you login, you have to supplement your profile like name, address, etc.

- 4.After that you have to photograph the base card, PAN card and selfie.

- 5.If you match the basic record of Kissht App, you get the Credit Line Amount.

- 6.After that, you have to accept Kissht Loan App Loan Agreement Policy

How to Use Kissht Credit Line?

If you get a credit line loan from Kissht Loan App, you can use it for 14 days. After 14 days, you have to make a loan Amount Repayment, and after Repayment, you can transfer the Credit Line Amount to your bank account. This is how 14 days of cycle time will last ; It can be for 2 years.

How much interest is charged on Kissht Credit Amount?

Interest is taken annually from 16% to 26% on Kissht Credit Line.

What is happened if loan not repayment?

- 1.If you are not able to repayment for 14 days, you will be charged interest as per the interest rate per day.

- 2.There is no limit to the interest and the company takes a loan agreement prior to you;

- 3.Your CIBIL score may also be lower so you’ll have trouble taking a loan in another place.

App Download:- Kissht Loan App

Click Other Best Loan Apps:- Best Loan Apps

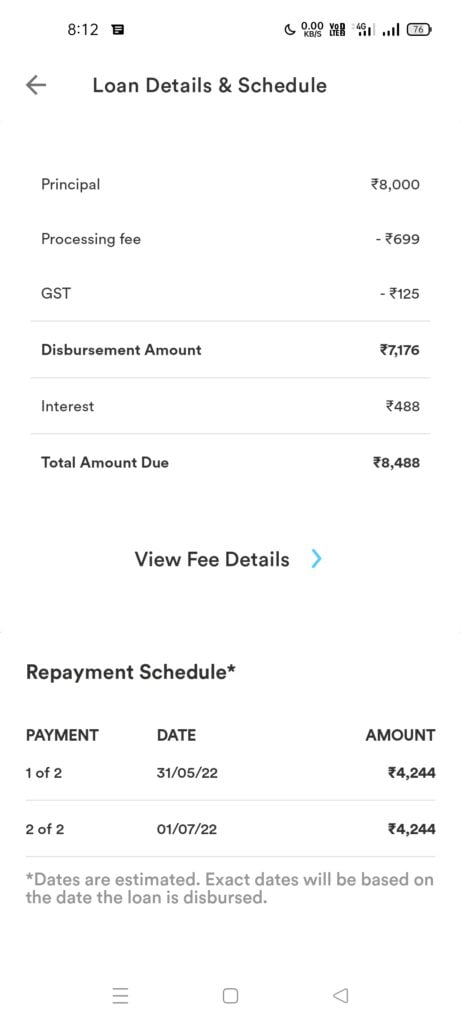

Branch App

This is an Rbi Registered Loan App which gives online loan / finance and with this loan app you can take online loan sitting at home, you only have to enter PAN card number to take loan. You get approval from this loan app if your civil score is 650+

What is Branch Loan App Online Details?

Based on the online data, the information like rating, review, download of this loan application is given in the table below…..

| 1. | App Name | Branch Instant Loan |

| 2. | App Downloads | 10M+ |

| 3. | App Ratings | 4.5*/5 |

| 4. | Reviews | 677K+ |

| 5. | Loan Amount | Rs.750 – 50,000 |

| 6. | Tenure | 2 Months to 6 Months |

| 7. | Interest | 2%- 3% Monthly |

What are the documents required to take loan from Branch Loan App?

By the way, you get a loan from this loan application without income proof or without bank statement, still there are some important documents which are needed to apply for the loan, such as ..

- Your age should be more than 18 years.

- Mobile Number

- PAN Card Number

- Bank Account Number

- Photo Selfie

How much loan can be taken from Branch Loan App?

With this loan app, you can avail an instant loan as low as ₹750 and as high as ₹50,000.

For how long does Branch Loan App give loan?

- The maximum EMI limit for this loan app is 6 months.

- How much interest is charged from Branch Loan App?

- 2% to 3% month .

How to take loan from Branch Loan App?

- First of all you have to download the Branch Loan Application.

- After that you have to login inside it with your mobile number.

- You have to put your documents like PAN card number, bank account number and your selfie.

- After that your credit score is checked.

- After checking the credit score, you get loan approval.

- If you are taking a loan for the first time, then you get the first loan approval between ₹ 750 to 3000.

App Download – BRANCH LOAN APP

0% Interest Loan Apps :- Apps List

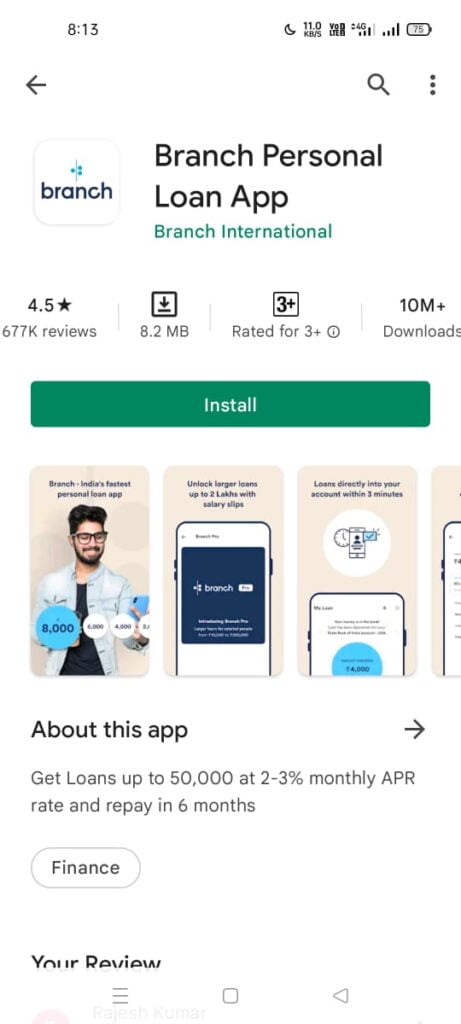

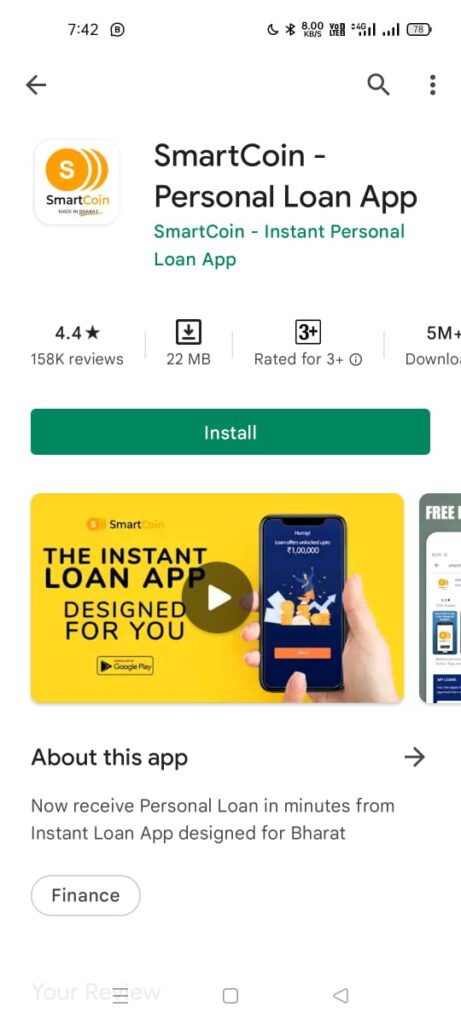

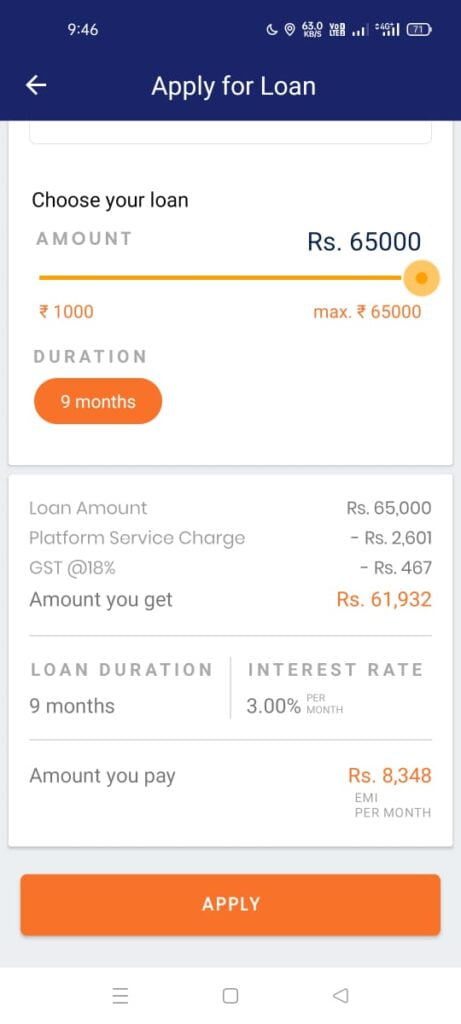

Smartcoin App

Smartcoin is an online finance application which is RBI registered NBFC. Loan application gives loan online. Based on the online information, its details are as per the table given below…

| 1. | App Name | SmartCoin – Personal Loan App |

| 2. | Downloads | 5M+ |

| 3. | Ratings | 4.4*/5 |

| 4. | Reviews | 158K+ |

| 5. | Loan Amount | Rs. 1000 – 1,00,000 |

| 6. | Tenure | 2 Months – 12 months |

| 7. | Interest Rate | 0% – 30% Yearly |

How much loan can be taken from Smartcoin App?

With this loan app, you can take a minimum loan of ₹ 1000 and a maximum of ₹ 1,00,000 online.

How much is the interest of Smartcoin App?

The interest rate of this application varies between 0% to 30% per annum.

For how long can I take loan from Smartcoin App?

A loan can be taken from this loan app for a minimum period of 62 days and a maximum of 180 days.

What are the documents required to take loan from Smartcoin App?

- First of all, your age should be more than 18 years.

- You must be a citizen of India.

- You should have Aadhaar Card PAN Card.

- You should have bank statement or salary slip as income proof.

- And you should have a valid bank account.

What are the features of Smartcoin App?

- First of all, its entire process is online, so you can take a personal loan online in just 10 minutes sitting at home.

- Any person can take a loan from this loan app whether he is salaried or self-employed.

- From here you can take loan on your basic documents.

- From here you get loan on EMI.

App Download: SmartCoin

How much is charged if the loan emi of Smartcoin App is late?

If the loan emi of this app is late, you can be charged additional interest up to 60% of the annual interest rate.

Watch Live Video

NOTE: These loan apps all information are behalf of app online database, providing through Google or Google play store or website itself.

Jai